city of montgomery al sales tax

The latest sales tax rates for cities in Alabama AL state. The Alabama state sales tax rate is currently.

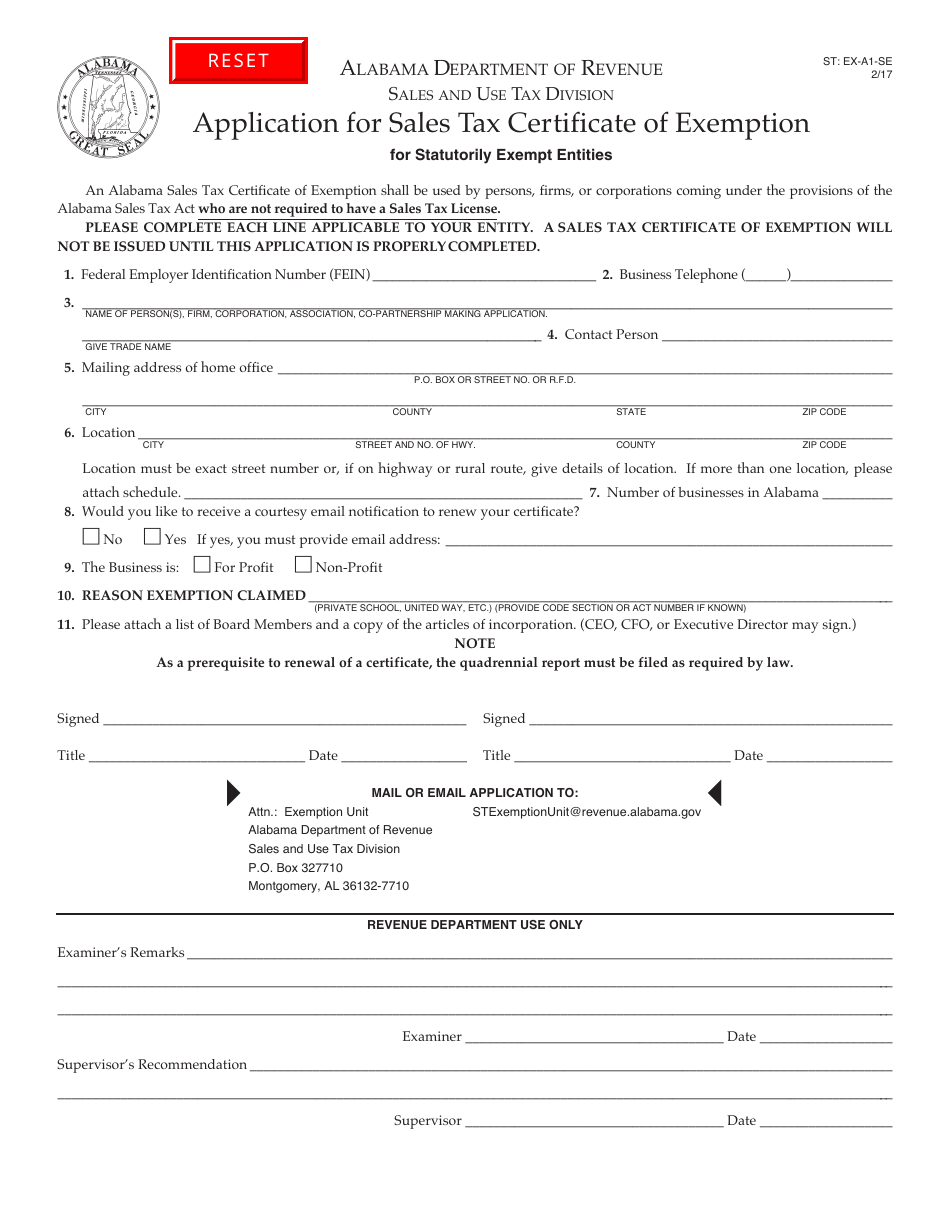

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Montgomery AL 36130 Email.

. Motor FuelGasolineOther Fuel Tax Form. What is the sales tax rate in Montgomery Alabama. Always consult your local government tax offices for the latest official city county and state tax rates.

SalesSellers UseConsumers Use Tax Form. Alabama AL Sales Tax Rates by City. This division oversees the collection of sales tax use tax and business taxes which include lodging gasoline and whiskey.

Free viewers are required for some of the attached documents. The businesses will provide 125 jobs according to the citys announcement and about 20 million annually in taxable sales. Interest For questions or assistance phone 334 625-2036 3.

The total sales tax rate in any given location can be broken down into state county city and special district rates. AL Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction.

10 of tax due. Montgomery County Alabama Sales Tax Sellers Use Tax Consumers Use Tax Education Only Tax MAIL RETURN WITH REMITTANCE TO. Instructions for Uploading a File.

Box 1111 Montgomery AL 36101-1111 4. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return your local taxpayer ID number assigned to you by these jurisdictions. The Montgomery Sales Tax is collected by the merchant on all qualifying sales made within Montgomery.

Childersburg tax rates for rentals made and lodgings provided within the corporate limits and police jurisdiction of the city. The Alabama sales tax rate is currently. 2 Reciprocity for City and County Taxes Rule 810-6-5-0401.

The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax. There is no applicable special tax. 1-334-844-4706 Toll Free.

Total purchase price of machines and replacement parts used in compounding mining quarrying. Therefore be advised to contact all counties and municipalities in which you do business in order to determine if you should register with them to collect their local tax. 2 days agoAccording to the data Alabama collected more than 272 million in taxes from alcohol sales in 2021 or roughly 54 per person.

The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax rate in Montgomery County. The latest sales tax rate for Montgomery AL.

For business entities new to Alabama the tax accrues as of the date of organization qualification or beginning to do business and is due 30 days. Montgomery County Commission Tax Audit Department P. For tax rates in other cities see Alabama sales taxes by city and county.

Montgomery AL Sales Tax Rate. Montgomery City Sales andor Use Tax. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

Montgomery AL 36104 Phone. Beer Tax updated Dec. 1 lower than the maximum sales tax in AL.

Area General Rate Manufacturing Machinery Rate. The Montgomery Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Montgomery local sales taxesThe local sales tax consists of a 250 county sales tax and a 350 city sales tax. Interactive Tax Map Unlimited Use.

Columbiana additional 4 sales tax on the retail sale of any liquor or alcoholic beverages excepting beer sold for on or off premises consumption. 103 North Perry St Montgomery AL 36104 334 625-4636. The phone number to contact the department is 334 832-1697.

Effective March 1 2008 the Tax and Audit Department will be the Montgomery County administrative entity for Sales Sellers Use Consumers Use Lodging Gasoline and Motor Fuel Taxes. Ad Lookup Sales Tax Rates For Free. Rates include state county and city taxes.

If you do not have one please contact Montgomery County at 334 832-1697 or via e-mail. The County sales tax rate is. However we do not administer all county or city sales taxes.

Penalty - Late Payment. The development will be. Sales and Use Tax.

For example a Montgomery. The Montgomery County sales tax rate is. 25 0333 State of Alabama.

Montgomery City Sales andor Use Tax. SALES TAX ALCOH. Taxpayer Bill of Rights.

Box 4779 Montgomery AL 36103-4779 Tax Period and complete lower portion of back side TOTAL AMOUNT ENCLOSED Make check payable to. The Montgomery County Sales Tax is collected by the merchant on all qualifying sales made within Montgomery County. If you need information for tax rates or returns prior to 712003 please contact our office.

Interest For questions or assistance phone 334 625-2036 3. Northport AL Sales. Penalty - Late Payment.

Alabama has a 4 sales tax and Montgomery County collects an additional 25 so the minimum sales tax rate in Montgomery County is 65 not including any city or special district taxes. This is the total of state county and city sales tax rates. 24 rows SELLERS USE.

You can print a 10 sales tax table here. That was the third highest mark in the nation on a per person basis. The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250 county sales tax.

Montgomery County collects a 25 local. 10 of tax. 334-625-2994 Hours 730 am.

The Montgomery sales tax rate is. This is the total of state and county sales tax rates. Did South Dakota v.

This table shows the total sales tax rates for all cities and towns in. Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may call ALTIST Certified Auditors Complaint Hotline. Montgomery collects a 6 local sales tax the maximum local.

For tax information. Object Moved This document may be found here. The State of Alabama administers over 200 different city and county sales taxes.

Help us make this site better by reporting errors. Box 1111 Montgomery AL 36101-1111 4. Total purchase price of machines and replacement parts used in compounding mining quarrying or manufacturing of.

This rate includes any state county city and local sales taxes. Sales Tax Calculator Sales Tax Table. Only one city andor county sales use or lease tax may be collected irrespective of rate.

The minimum combined 2022 sales tax rate for Montgomery County Alabama is. 2020 rates included for use while preparing your income tax deduction. The License and Revenue Division assists businesses in the City of Montgomery in issuing and maintaining appropriate business licenses and sales tax numbers.

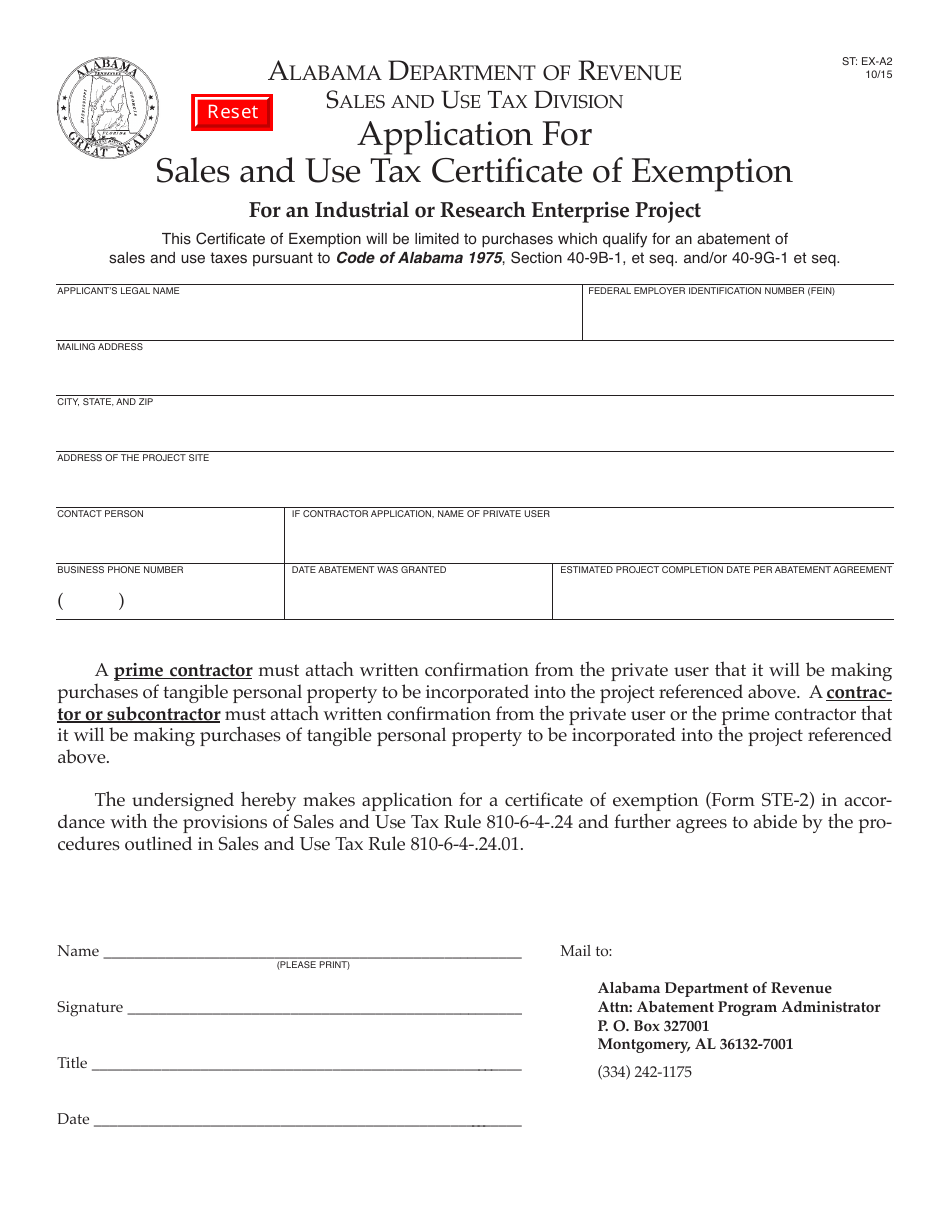

Form St Ex A2 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project Alabama Templateroller

Montgomery County Courthouse Price Phelps Justice Center A County Office Montgomery County Al

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

/cloudfront-us-east-1.images.arcpublishing.com/gray/P2FCAJHMVFH53PHSZUUH2ED7RY.jpg)

Crews Work To Renovate Montgomery S Patterson Field

Online Sales Tax Collection What Does This Really Mean For Alabama S Municipalities

Appraisal Montgomery County Al

Martin S Restaurant Here S How Montgomery S Tax Collection Works

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Gis Mapping Tool City Of Montgomery Al

Alabama Sales Tax Guide For Businesses

/cloudfront-us-east-1.images.arcpublishing.com/gray/7G5DE6CHTVEVJMSL4ADUFASQEI.jpg)

Clothes School Supplies Diapers Electronics Among Items In Alabama S Sales Tax Holiday

Montgomery City Council Revokes Business License Of Martin S Restaurant Alabama News

Historic Alabama Restaurant Has License Revoked Due To Failure To Pay Sales Taxes Al Com

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders